tv [untitled] November 15, 2012 3:30am-4:00am EST

3:30 am

from a hearing of the senate banking committee on the balance all three bank capital rules that gentleman was talking about how important they are for good reasons but our guest is here to tell us why this issue has such a bearing on the economy and is so important to a discussion about its prospects and could be a very dangerous thing from our new york studio is chris whalen senior managing director at tangent capital partners and author of the book you see here inflated and as always chris whalen thank you so much for being on the show really appreciate you being on. or ok so basil three as the man in the hearing said the stronger capital standards for pros under these rules would significantly lower the probability of a banking crisis and their associated economic losses i would tend to listen to him and say yeah sounds great sounds sounds right last week regulators delayed the timeline for basil three a you say this is they realize that this was going to put the western economies into a prolonged recession how so how does how does making banking safe or equal of

3:31 am

recession recession a prolonged one at that. well i think the chief fallacy of the basel three process is that a lack of capital caused the crisis in fact the assurance of bed fraudulent securities and the really disintegration of investor confidence is what caused the crisis no amount of capital would have helped us in two thousand and seven so in response to the crisis the regulators the congress have all been talking tough on bank capital as though that was a problem when i think in fact it was just the opposite it was other problems in the in the industry especially fraud so today you have this weird situation where we're going to increase capital levels and banks which means are not going to lend as much and this in turn is going to hurt the economy because we're going to have less credit available to what extent though to what extent does asking banks to

3:32 am

require a little more capital really mean that they're going to stop lending to the extent that we would see a prolonged recession. well it's a whole number of pieces of fit into this puzzle but if you took bank capital just a change in the demeanor of regulators over the last couple years the new rules for getting guarantees from various government agencies for mortgages all of these changes have a centrally added friction in the economy decrease to bail ability of credit and we need to have as much credit being created obviously you're not going to have a good job market so i think that we're kind of cutting our nose off to spite our face we're trying to talk tough on capital on the one hand and at the same time you have this debate about the fiscal cliff and everything else i wrote a piece that we posted on zero hedge today talking about this dichotomy because we can't do the right thing on fiscal issues we have bad housing policy that causes wall street to just about collapse and yet we're going to talk tough on bain

3:33 am

capital as was the one nine hundred eighty i think we got to do a bit of a sanity check here and try and crater the economy in terms of growth rates while we slowly get the fiscal house in order you were just talking about a bill a trillion six in the revenue increases that the president wants you know the reality is no matter what deal they cut on the fiscal cliff lauren it's going to hurt the economy because we've been goose ing growth by using debt instead of tax revenues to pay our bills so if you start taxing more obviously the economy is going to slow down of course but my question on that is everybody is so worried about the fiscal cliff and it's understandable why c.e.o.'s would be worried they're focused on short term profits they see a recession coming and they go this is bad for business but why would it be so bad for the economy if we have a little recession next year but longer term are on a better path because we've got on the fiscal house more in order in the u.s. well i think you want to do these things gradually if you raise dividend tax rates

3:34 am

over forty percent you're going to change the asset allocation behavior of a lot of fun minute. there's a wall street and you're going to have carnage in the equity markets as a result i think you want to do these things slowly and deliberately so you don't scare people even more than there are already scared today and try and get a precipitous political way but i got to tell you i am very skeptical that the republicans and democrats are going to come together short of some sort of apocalypse in fact i think the republicans would rather go over the cliff and then blame president obama with the results because this was kind of his idea and why not let him take ownership of it if they do go over the cliff i'm curious because from the perspective of a middle class american if their income tax rates go up if the payroll tax expires if that happens if that happens say to me i would see a little less of my paycheck it would be a bummer i'd be upset i probably would have to cut some corners here or there it

3:35 am

wouldn't be the end of the world so we're going to have our names would come ok so so that's why it's so so here's me saying now but what do you think is the broader consequence because you just mentioned carnage in the equity markets and dividend taxes go to forty percent which is the tax rate they would go up to if we go off the cliff so so where do you think the carnage would really be in january if we went off the cliff just right away with there being well i think in terms of the business community the uncertainty would continue because people would believe that at some point the congress would go back and fix it in other words they would change the tax laws again i think the real problem here lauren is that we've been in a short term sense trying to extend and increase nominal growth nominal job creation for so many years that if you start to really tax this economy at eighteen or twenty percent of g.d.p. instead of fifteen were tax revenues or today you're going to take so much income out that you've got to see job losses you've got to see

3:36 am

a decrease in consumer spending that i think would guarantee that we're in a recession but let me put it to you this way even if we have a short. term deal that pushes this issue down the road a few months or a year what have you i still think two thousand and thirteen is going to be slow because of bird dubious about the housing sector you alluded to that before but i think in general there's such tight credit availability in many markets that it's almost guaranteed i think that we're going to have growth below what people are estimating right now ok and i want to get into housing a little bit later but but what you just mentioned about tight credit. ok you're saying credit is tight how tight is it right now and we don't have tighter capital requirements so i don't want to say i'm making credit so tight right now well most banks if they're making mortgage loans ninety percent of their volume is getting guaranteed by the federal government to get that guarantee without a lot of fees and private mortgage insurance you're looking at a minimum five go score for the borrower of about seven forty and you're looking at

3:37 am

an eighty twenty load in other words twenty percent down on the house and the agencies really want to see thirty percent down so what that means is that about half of the total population of potential home buyers out there cannot qualify for government guaranteed loans now the banks are not really writing an awful lot of conform conforming loans now in other words loans they would keep on their books and take the risk on as opposed to a government guaranteed loan where the bank really doesn't take any risk the risk gets pushed to washington so right there you can sense that the banks are not taking a lot of the risk they don't want to take risk and that means that there's a very large percentage of the total population out there they're really candy the refinance or existing mortgage or get a new mortgage on a new home purchase in some states california the southwest some parts of the southeast the markets are doing pretty well but here in the northeast basically from new york on up into new england we still have a huge problem because these are all states where you need

3:38 am

a judge to bang the gavel in or do a foreclosure so if the recovery in real estate is very. very regional and i think by the end of the year we were january february timeframe we'll probably see the case shiller home index numbers going down again and that because right and that's what educators people are looking to saying housing is improving before we get into housing i do want to just finish up on this three this discussion because we got away from it but how would it have been different in two thousand and eight if we had higher capital requirement because you're saying it wouldn't matter but if banks have more capital and a liquidity crisis does not mean they would have more liquidity because capital is cash and things that can be easily liquid right so that would have helped. well lauren on the day or net period of months during the crisis nobody had liquidity even government agency paper was very difficult to sell and you couldn't use it as collateral so this whole notion that there would have been liquidity available i

3:39 am

think is specious the more important thing is remember the basel framework basel two essentially enabled the crisis because it said to people if you create a bond and you get a aaa rating from moody's no matter how crappy it is inside then it has a lower capital weighting that alone so what we said to wall street is sell bonds and they did and they gauge and all kinds of fraudulent activities that have largely gone and punished so where was it in this whole series of events that we needed more capital what we needed was a much tighter regime on the creation and sale of securities but nobody wants to talk about that if you look at loan loss rates in the banking industry say from zero seven forward they were very high but we had plenty of capital to absorb them u.s. banks have twice sometimes three times as much capital as their european counterparts so it really is i think a false argument to say that higher capital levels would have constrained wall

3:40 am

street because they still would have issued all those bad securities ok so you're saying they would have issued bad securities but the. they wouldn't necessarily be lending to the average joe schmoe without fear though one of the arguments was that it wasn't fully implemented by two thousand and eight but by two thousand and eight it had been lowering capital requirements and so capital was less that's another reason why people say made well the thing about crisis worse is that right in the loop the right to leverage ratio in the us which is just capital versus told is really the reason the u.s. banks are in better shape most u.s. banks never got to the basel limitations floor and they usually run into their leverage ratio limits for what people don't realize basel really applaud in a significant way the large banks because it let them play games with different kinds of risk waits for assets for your typical day to leverage ratio was to governing rule ok well we'll leave it there for now but when we come back we're going to talk much more about housing and this idea that there's

3:41 am

a so-called recovery he got into a little bit of it we're going to do a lot more after the break with chris whalen of tangent capital partners also still ahead we've seen college tuitions go up as states have become cash strapped in the u.s. but could universities loaded bureaucratic budgets be part of the problem we'll explain in tonight's loose change but first your closing market numbers. see good lumber jury was easy to believe when its most sophisticated.

3:42 am

lead doesn't usually don't. an amount any. mission to teach creation why it should care about humans in the world this is why you should care only on the dog. you know sometimes you see a story and it seems so. you think you understand it and then you glimpse something else you hear or see some other part of it and realized everything you thought you don't know i'm tom harvey welcome to the big picture and.

3:45 am

my eye today it said could housing be the antidote to the fiscal cliff i don't know some people probably hope so there certainly seems to be this consensus building around this idea that us housing is we're covering sounds like our guest has a lot of reason to say not so fast guys let's hear why chris wayland senior managing director from tangent capital partners will explain so chris this article was was talking about the chief investment strategist at charles schwab who is saying that the economic recovery is going to be built literally with four walls it's housing it's it's it's recovering and it kind of as this consensus it seems like it is building around this idea that the u.s. housing market has turned in his recovery is it. no i think go the way we're going to define recovery is that prices are going to stabilize in some markets where you have a lot of either investor activity or just local demand you're going to see prices go up single digits but the days of housing i think is the dominant most

3:46 am

expansive part of the u.s. economy which it was for quite a number of years i think or over there's just so many headwinds as my friend josh ross or likes to say that used to be tailwinds number one being demographics the baby boomers are looking to live in florida now and they have a lot of homes that they want to sell here in the northeast the northeast is by far and away the part of the country that's going to feel least benefit from any recovery in housing simply because we have still years of backlog in terms of foreclosure states like connecticut or just a disaster especially the higher end homes above the the maximum amount that you can get a government guarantee which is about six hundred thousand dollars there is no no loan market for these homes so you're basically waiting for a cash buyer states like connecticut for example where you are massachusetts excuse me where you can't foreclose well what investor is going to want to write

3:47 am

a loan in massachusetts so i think that you have to be very careful and look at different regions of the country and they're going to have very different performance characteristics i don't expect to see housing pulling the u.s. economy forward the positives are low energy prices the export sector some other sectors of the economy they're doing relatively well but if the job market doesn't come back lauren then that's what's really going to weigh on housing if you have people renting instead of buying and then that's going to be a very tough situation to just soak up all of that inventory that we have and so many of these markets well speaking of every rantel i mean that's one of the things that we here are private equity investors getting in buying houses to rent them kind of a new way to say our batsmen strategy. a lot of talk behind this and i know there is action you say in some markets is private equity money is actually creating bubbles but the can this kind of money this kind of homebuyer fuel a recovery because in the past it hasn't been investors or even first time buyers

3:48 am

that have driven the bread and butter of housing in the us hasn't been just mortgage homeowners that move every six to eight years into another home yes and no i mean if you looked at florida if you look at arizona those markets there was a lot of investor activity in the past this time around you have private equity funds soaking up the excess inventory often at retail valuations and i'll tell you right now i don't think the investment thesis works there real estate especially rental properties or a local business it's very hard to run on a national basis and i think that a lot of the expectation is for double digit returns on cash from rental investments by these private equity firms are going to prove to be wrong well then what does that mean in these areas that you say private equity money is actually creating a bubble in some regions what does that mean at these as these investment schemes don't turn out to be what they had hoped well it means that someone bought that house which is good so in that sense look at arizona very classic example prices of

3:49 am

big going back up and that's in part because you had an awful lot of investor dollars hit the market and very quickly push prices from deep discounts to premiums overall for prices i don't find it very attractive but you know the real pain there will be felt by the investor the short term benefit is that the housing market tightened up same thing with southern florida parts of the west coast parts of the east coast of florida about halfway up but then the top half of the state is still a wasteland nobody wants to touch it and you see the same sort of things up and down the east coast certain markets that are attractive have bounced back a bit but by and large the dearth of financing. lower population are the smaller population of potential home buyers and other factors i think are going to limit the gains you're going to see in housing it's going to be a single digit proposition i think both ways so like i said before i would expect

3:50 am

to see housing prices soften once we see the case schiller numbers for october november december simply you know for no other reason than seasonality but also i think because you know the spurt we saw this year has slowed considerably since what about what about shadow inventory what about foreclosures that have not been gone through with yet i mean what is the reality of this backlog that is still hasn't been put out on the market or has been foreclosed on or works through because there is some sort of some of these reports of a tight supply in some areas is that they're not very tight supply and this is deliberate the banks like to take their time on foreclosures they're in no hurry in new york or new jersey or connecticut because they know that the market is limited so between the delay in the courts plus other factors for every house you have for sale today what i tell my clients is there's another house just like it waiting to come on the market if prices do go up these are discouraged sellers who wanted to

3:51 am

see prices go up voluntary sellers monday right but then there's probably another house just like that that somewhere in process between default and the final foreclosure the debate can't sell yet we have an awful lot of of inventory that you can't even see because until the judge bangs the gavel the bank doesn't own the house and they don't count it as part of their statistics so even though it is a default and even though the homeowner may have left or the bank may have told the homeowner to stay in the house until they finish the foreclosure process eventually those homes are going to be hitting the market and you see this with the government agencies to the f.h.a. fannie and freddie have enormous inventories of unsold homes that they're trying to read right now. and that's kind of the. dirty little secret they're pushing the literal market in the hope that they don't know if the real was lost by selling the house at a substantial distil all right chris whalen bringing us dirty little secrets and shattering the conventional wisdom on housing really appreciate you being here

3:52 am

thanks so much chris whalen is already going to wreck their tangent capital partners. let's wrap up with loose change first major one thing that was sticking out to me when chris whalen was so bearish on housing in the northeast i think they have hurricanes now the furthest profound people are going to live there are actually true when you talk about that all the time i was joe i'm joking because one of the los angeles where there's not hurricanes just earthquakes. and they've been saying the big one was coming for a long time in california i should know i've lived there and we're talking about domes and i was in the volcano movie there was a volcano you i don't know of a movie reference for everything i told you that was one of his troopers of all.

3:53 am

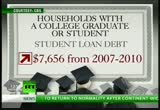

and i don't think that's probably enough but let's move on to an actual story that we do know about we all know in these economic times the middle class is hurting college students are hurting they faced staggering numbers of student debt took. one in ten families that has student loan debt now owes nearly sixty two thousand dollars seven thousand dollars more than just three years earlier total u.s. student loan debt has surpassed one trillion dollars. that's those are some staggering statistics what might be contributing to them we know that tuitions costs have gone up we know that states have cut funding and so it's schools have to charge more in cash strapped states and what could be complicating this ministry of cost are those bloated have those become more bloated the overall statistics show that they've increased i think ten fold over the last several years. and now some

3:54 am

professors are revolting at purdue they're revolting because they're saying hey this is not right it misread it costs are soaring they have all these high paid administrators and yet we are not hiring more faculty and we're supposed to not be gouging students i mean i think this is interesting because we often talk about bureaucracy with the government but public universities is i mean it sounds like a similar issue or sort of thing is true hospitals and i used to have that came to mind came to mind and it is true of cost keep going up and up so you think of a ha you think of hospitals a place to go for health care you don't realize there are so many administrative costs that are leaking into that and a lot of has to do with regulations and all sorts of other overhead that wasn't there before so i think it's interesting i mean you know i'd like to see what the total breakdown is there's a write down i had on an article that i can find out so let's move on to pepsi it's released a new drink in japan with the promises that will help soda drinkers lose weight. pepsi as we know it today in just. the commercial she's special and to claim

3:55 am

it just might make you place ribs. so they put some ingredient in it that to me just sounds like they put it in so they could say that they have a new fat blocking soda it's released in japan my question why is it released in the us the us totally goes for these kind of weird diet schemes why don't i just thought of this literally because i try to come up with something on the spot this could relate to monetary policy lauren i think that this is part of the great japanese the what is should we used to eat in floyd north again way now we're eating so we lose weight right so so now this pepsi goes you know this pope's pepsi with this giant hunk of lamb or ducks for gras. and i'm worn your father was a legal well of regulation i don't know where it's i want to pick my i want to go

3:56 am

to california and the fog won't keep you there but i think this is the way of the future drink you drink pepsi you lose weight it's not diet it's literally deflation of. the flesh very color for a deflationary economy took them two decades to come up with that that's how long. that was going all that was reading over the comedies of the place and it was clever i'll give you that and i will give you our final word because that is all we have time for thank you so much for watching be sure to come back tomorrow and in the meantime you know you can follow me on twitter and you can like our facebook page right there you can watch us in you tube or in h.d. on hulu and you can come back tomorrow we all hope you do until then have a great night. download the show to the cation so choose your life stream quality and enjoy

3:57 am

3:58 am

michel would be soon which brightened a few. songs from the finest impression. means funds don't totty don't come. do we speak your language anybody will not advance. news programs and documentaries and spanish matters to you breaking news a little tonnage of angles couldn't storage space. or you hear. the choice at all to spanish find out more visit eye to eye all tito is calm.

3:59 am

25 Views

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11